The Climate Benefits from the Inflation Reduction Act

Description

This training on the Climate Benefits from the Inflation Reduction Act of 2022 reviews all the energy and climate items in the bill, how much reduced US greenhouse gas emissions, and what climate solutions were retained after passage of the One Big Beautiful Bill Act of 2025.

Breadcrumb

/topics/inflation-reduction-act

TOC and Guide Section

Why was a climate bill called “The Inflation Reduction Act (IRA) of 2022”?

- The IRA modestly curbs inflation in the short-term by raising more revenue through tax reforms and other measures than it spends on clean energy and other policies. As a result it effectively takes some money out of circulation and thus cools the economy.

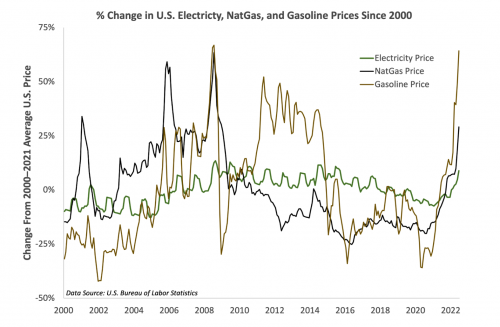

- The IRA guards against long-term inflationary pressures by accelerating the transition away from fossil fuels and their volatile prices towards electricity and its stable prices, as illustrated in the chart below.

- Moody’s Analytics thus says the IRA will “nudge the economy and inflation in the right direction, while meaningfully addressing climate change and reducing the government’s budget deficits.”

- And the Center for a Responsible Federal Budget says: “we expect the IRA to very modestly reduce inflationary pressures in the near term while lowering the risk of persistent inflation over time.”

What climate provisions were in the IRA?

Clean Energy Tax Credits

- Technology-neutral tax credits for the investment in and production of low-carbon energy sources:

- Solar

- Wind

- Battery storage

- Geothermal

- Nuclear

- Hydroelectricity

A fee on methane pollution!

- The first ever federal fee on climate pollution

- 2024: $900/ton ($36/ton CO2 equivalent)

- 2025: $1200/ton ($48/ton CO2e)

- 2026 and thereafter: $1500/ton ($60/ton CO2e)

- About 60% of methane leaks fixed for $5/ton, 70% for $40/ton CO2e

- Projected to raise $8 billion in revenue, boost the economy, create jobs to fix all those methane leaks

- Provides $1.5 billion in grants to oil & gas companies for methane reductions, monitoring, reporting

- Facilities are exempt if in compliance with EPA methane regulations

Nature-based climate solutions

- $5 billion for forestry programs

- $2 billion for wildfire prevention

- $1.5 billion for urban and community forestry grants

- $1 billion for forest conservation

- $450 million for climate-smart private forest management incentives

- $100 million for wood innovation grants

- $21 billion for climate-smart agriculture and conservation including agroforestry, silvopasture, cover cropping

Electrification, green bank, and environmental justice

- $10 billion in consumer home energy rebate programs, including rebates & tax incentives for heat pump water and space heaters, clothes dryers, electric stoves, insulation, windows, wiring

- $200 million to train contractors in electrification & efficiency

- $3 billion for the Post Office to buy more EVs

- $27 billion for a green tech accelerator (national green bank)

- $60 billion in environmental justice priorities to invest in disadvantaged communities

Domestic manufacturing and innovation

- ~$60 billion for domestic clean energy manufacturing

- $40 billion tax credits for US solar, wind, batteries, EVs, and critical minerals

- Up to $20 billion in loans to build EV manufacturing facilities

- $2 billion to retool car plants to make EVs

- $2 billion to National Labs to accelerate breakthrough energy research

- $500 million for the Defense Production Act

- $250 billion in loan authority to the Department of Energy for lending to new green companies/technologies

And much more!

- 45Q tax credit for carbon sequestration ($3 billion)

- $85/ton for stored CO2, $60/ton for use in enhanced oil recovery

- Production tax credit for nuclear power ($30 billion)

- Extended tax credits for biodiesel fuel ($5.6 billion)

- Tax credit for aviation biofuel reducing emissions by at least 50% ($50 million)

- New tax credit for clean (low-CO2) hydrogen ($13 billion)

- Permanent coal tax extension to fund Black Lung Disability Trust Fund

- Requires 2 million onshore & 60 million offshore acre acres offered for lease per year as a prerequisite for similar solar & wind leases

How much would the full IRA have cut emissions?

- According to modeling by the energy systems experts at the Princeton REPEAT Project, the IRA would have cut US emissions by about 7 billion tons of carbon dioxide-equivalent climate pollution over a decade. That's more than a full year's worth of US climate pollution.

How much of the IRA survived the so-called One Big Beautiful Bill Act of 2025 (OBBBA)?

- Clean energy tax credits for solar and wind power are terminated for projects that don't begin construction by July 2026

- Clean energy tax credits for battery storage, geothermal, nuclear, and hydroelectricity are phased out beginning in 2034

- Electric vehicle tax credits were terminated on September 30, 2025

- Home efficiency and electrification and rooftop solar tax credits are terminated at the end of 2025, as was the tax credit for clean hydrogen

- But tax credits for leasing rooftop solar systems were largely preserved

- The fee on methane pollution from oil and gas production was frozen, set to $0

- The carbon capture and storage and biofuels tax credit remain in place into the 2030s

- Approximately two-thirds ($62 billion out of $94 billion) of the IRA's various clean technology grant, loan, and rebate programs were dispersed by federal agencies

- A lot of clean energy – especially solar farms and battery storage systems – was deployed in the three years between the IRA and the OBBBA, as illustrated in this chart from American Clean Power:

How much of the IRA's climate pollution reductions were preserved in OBBBA?

- According to modeling by the energy systems experts at the Princeton REPEAT Project, the clean technologies deployed between 2022 and 2025 and the surviving clean energy tax credits will cut about 1 billion tons of carbon dioxide-equivalent climate pollution over a decade.

- That's like permanently shutting down 26 coal power plants or taking 23 million cars off the road

- The Trump EPA rollback of federal climate regulations also substantially cut into America's climate pollution reductions

While a far cry from the IRA's projected 7 billion ton cut in climate pollution, 1 billion tons is still significant progress and deserves to be celebrated while we continue to work towards cutting the next billion tons!

Length

Press play to start the video (41m 13s)

https://vimeo.com/showcase/9757371

Video Outline

Instructor(s)

- Dana Nuccitelli

Downloads

- View or download the Google Slides

- Download the video

Audio length

Press play to start the audio (41m 13s)

Audio embed code

Audio Outline

Skip ahead to the following section(s):

- (0:00) Intro & Agenda

- (2:34) Background

- (5:30)What’s In the Bill On Climate?

- (20:54) How Much Will It Cut Emissions?

- (27:09) How Many Lives Will It Save?

- (35:11) What Doesn’t It Accomplish?

- (36:54) Taking Action

Instructor(s)

- Dana Nuccitelli

Downloads

Have you completed this training?

Let us know if you've completed this training! Your progress will be logged in the Action Tracker so you can reference a list of trainings that you've completed.

Log your training

Category

Training

Topics

Climate Policy

Format

Audio / Video, Presentation

File Type

Google Slides, PowerPoint (.pptx)