Home Electrification and Efficiency Opportunities from the Inflation Reduction Act

This training reviews the various incentives available to homeowners through the Inflation Reduction Act, the benefits of each technology, and details regarding the applicable tax credits and rebates.

Why go electric?

There are three great reasons to replace fossil fuel technologies with electric alternatives: curbing climate change, improving your health, and saving money.

Climate: Even if the electric grid isn’t totally clean, electric technologies still generally produce significantly less carbon pollution than fossil fuel alternatives. That’s because burning fossil fuels is very inefficient – it creates a lot of waste heat that’s lost to the surrounding air. Plus the electric grid is only partially powered by fossil fuels, and is rapidly becoming cleaner.

Health: The burning of fossil fuels generates a lot of other air pollutants that contribute to adverse health effects. These include nitrogen oxides and particulate matter from car and truck tailpipes that contribute to smog and premature deaths, and nitrogen dioxide from gas stoves that can cause childhood asthma. Electricity generated from fossil fuel power plants also produces air pollution, but the electric grid is rapidly becoming cleaner.

Money: Because today’s most advanced electric technologies are more efficient than fossil fueled alternatives, they can substantially reduce monthly household energy bills. According to Rewiring America, families could save up to $1,800 per year on lower energy bills by taking advantage of all the electric upgrades incentivized by the Inflation Reduction Act (IRA). Electricity rates are also much more stable than fossil fuel prices.

Your Inflation Reduction Act home electrification bank account

The IRA essentially created an electrification and efficiency bank account from which each homeowner can withdraw. The funds in the bank account are divided into two buckets: tax credits and upfront rebates.

Illustration of the tax credit and upfront rebate incentive “buckets” in the IRA. Created by the Fairfax County, Virginia CCL chapter.

The tax credits are already available to homeowners for energy efficiency home improvements, solar panel and/or battery storage systems, and electric vehicles (details provided in the sections below). Homeowners can claim these credits through their annual federal tax filings. For example, if you install a heat pump in your home in 2023, you can include the associated tax credit when you file your tax return due in April 2024. Most of the tax credits are worth 30% of the technology cost, but there are exceptions and caps, as we’ll see below.

One downside is that these tax credits are all non-refundable, meaning that if the credit is larger than your tax liability (e.g., if you owe the federal government $1,000 but your tax credit is $1,200), you won’t be able to use the full credit that year. However, many of the tax credits reset every year, so if you space out your upgrades you can take advantage of the credits over several years. And you can carry over any unused credit from rooftop solar and/or battery storage installations to the next tax year (this is called a “tax carryforward”).

There are two main groups of upfront rebates stemming from two bills that were included in the IRA: the High-Efficiency Electric Home Rebate Act (HEEHRA) and the Home Owner Managing Energy Savings (HOMES) Act. Homeowners can only apply for one or the other. In general, the HEEHRA is more generous for low- and middle-income families (with a $14,000 ‘bank account’ available for each qualifying household), while the HOMES Act will be most applicable for high-income households.

“Low-income households” are those whose income is below 80% of the local median income, while “middle-income households” are those at 80% to 150% of local median income. The HEEHRA rebates will cover 100% of upgrade costs for low-income households and 50% for middle-income households, up to $14,000. How do you know if you qualify? Use Rewiring America’s amazing IRA calculator! You can also look at the Department of Housing and Urban Development’s local median household income data, and Fannie Mae’s mapping tool to find your local median income.

To distribute these rebates, the Department of Energy must set up programs with each state’s energy office. That’s a complicated and slow process, because each state will have to establish programs that demonstrate compliance with the IRA requirements, including eligibility of household, technology, and program reporting. The rebates will be rolled out in individual states starting in 2024 and continuing through 2025. Until those state programs are established, we won’t know how homeowners can access the rebate part of their electric bank accounts. CCL will update this space as those rebates become available.

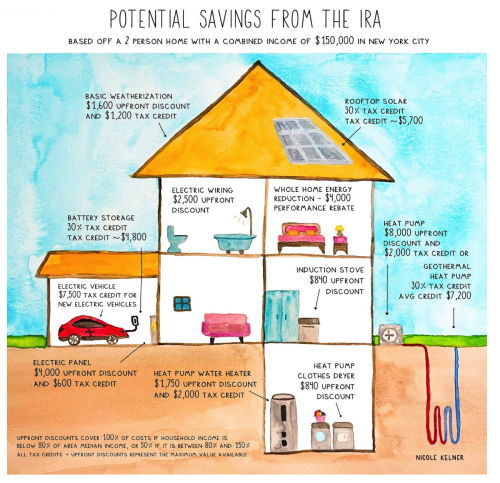

Now let’s look at the benefits of all the available electric and efficiency technologies and the tax credits and rebates that will be available for each, summarized in the great illustration below by artist Nicole Kelner.

Illustration of the IRA tax credits and rebates that will be available to homeowners. Created by Nicole Kelner.

Home heat pumps

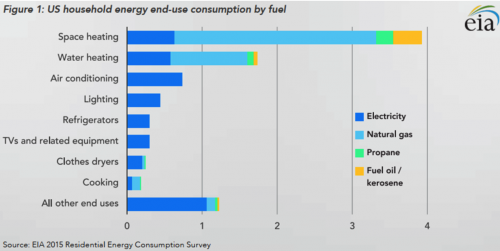

As illustrated in the chart below, most of the energy used in American households – and especially the fossil fueled energy – stems from space and water heating. Fortunately we have an incredibly efficient electric technology that can tackle both of these applications – heat pumps!

A heat pump basically moves heat from one place to another by using electricity to power a fan and air compressor. It can take heat from outdoor air (or water, or the ground) in the winter and bring it indoors, or take heat from the air in your home during summer and move it outdoors. The latter is basically what an air conditioner does, but a single heat pump unit can move heat in both directions, so you don’t need a separate furnace and air conditioner.

Moving heat around in this fashion is much more efficient than generating it by burning fossil fuels, which lose a lot of energy as waste heat, or by using the old electric resistance heating technology. As a result, electric heat pumps are about three to five times more energy efficient than most current fossil fuel heating systems. That means they may save on monthly energy bills while reducing carbon and other air pollutants.

Contrary to popular belief, heat pumps can also work in cold climates, because there’s some heat available even in very cold air. Mitsubishi makes a model that works down to -13°F, and US companies are developing heat pump units that can work below -20°F. In fact, 60% of homes in Norway, 43% in Sweden, and 41% in Finland (all cold Nordic countries!) have heat pumps.

Heat pump costs can vary significantly depending on the size of your home, whether you need new ducting, and local labor costs. On average, including installation costs, a new heat pump system costs about $8 per square foot of home size.

Thanks to the IRA, there is a 30% tax credit available up to $2,000 for homeowners who install a heat pump (under Section 25C of the US Internal Revenue tax code). Once the HEEHRA rebate programs are set up by state energy offices, likely in 2024, low- and middle-income households can qualify for an $8,000 up-front rebate for a home heat pump system as part of their overall $14,000 home electrification bank account. That rebate will cover 100% of heat pump costs (up to $8,000) for low-income households, and 50% of heat pump costs (up to $8,000) for middle-income households.

If you’re thinking about getting a home heat pump, check out this webinar on the subject from Environment America and Rewiring America.

Heat pump water heaters

Heat pump water heaters transfer heat in the same way as heat pump space heaters and are thus two to three times more efficient than most current water heating systems. That can translate to hundreds of dollars per year in energy savings for an average household.

Heat pump water heaters qualify for the same 30% tax credit as heat pump space haters (Section 25C of the US Internal Revenue tax code), up to $2,000 combined. But the tax credit resets every year, so homeowners can spread out their upgrade costs by installing a heat pump space heater one year and a heat pump water heater the next year, qualifying for up to $2,000 in tax credits each year.

Heat pump water heaters cost between about $1,000 and $3,000. Once the HEEHRA rebate programs are set up by state energy offices, likely in 2024, low- and middle-income households can qualify for a $1,750 up-front rebate for a home heat pump water heater as part of their overall $14,000 home electrification bank account. That rebate will be able to cover 100% of heat pump water heater costs (up to $1,750) for low-income households, and 50% of heat pump water heater costs (up to $1,750) for middle-income households.

If you’re thinking about getting a heat pump water heater, check out this webinar on the subject from Environment America and Rewiring America.

Electric stoves

Traditional electric resistance stoves heat up a metal element, which in turn transfers heat to a pot or pan. Newer induction stoves use a magnetic field to create an electric current in iron or steel cookware, which in turn creates heat. Both electric stove technologies are very efficient – induction stoves even more so. Traditional resistance stoves have the benefit of being cheaper, but induction stoves are safer because the cooktop itself stays cooler (lower risk of contact burns!), they offer more precise temperature control, and they heat up liquids and food more quickly than other methods.

Gas stoves are less than half as energy efficient as electric resistance or induction stoves because a lot of the heat is lost to the surrounding air rather than being transferred directly to the cookware. Burning fossil gas indoors also generates significant amounts of air pollution, especially nitrogen dioxide, which contributes to childhood asthma among other illnesses. A December 2022 study found that in the USA, 35% of homes use gas stoves, which are associated with 6–19% of current childhood asthma cases in American kids.

All forms of cooking generate particulate matter pollution, and so using venting systems in the kitchen is a good idea when possible, but gas stoves produce much more indoor air pollution than electric alternatives.

The IRA did not include tax credits for electric stoves. However, once the HEEHRA rebate programs are set up by state energy offices, likely in 2024, low- and middle-income households can qualify for a $840 up-front rebate for an electric resistance or induction stove as part of their overall $14,000 home electrification bank account. That rebate will cover 100% of electric stove costs (up to $840) for low-income households, and 50% of electric stove costs (up to $840) for middle-income households.

If you’re thinking about getting an electric stove, check out these webinars on the subject from Environment America and U.S. PIRG.

Home weatherization

“Weatherization” refers to steps homeowners can take to reduce the energy required to heat and cool their home. It may involve air sealing, insulation, door and window upgrades, and ventilation improvements. A good first step is to get a home energy audit, which will determine the best ways to make your home more energy efficient.

Home weatherization is important and smart because up to 20% of the money spent on home energy by an average American is wasted through air leakage and poorly insulated walls and ceilings. Inadequate or improperly installed insulation can also result in condensation problems that can promote mold growth. Weatherizing homes thus reduces energy waste and bills. That’s especially true for older low-income households, which could save up to 35% on their energy bills through weatherization projects.

Similar to heat pumps, home weatherization projects qualify for a 30% tax credit (under Section 25C of the US Internal Revenue tax code), up to $1,200 per year with the credit resetting every year. The credits are capped at different levels for each upgrade:

- $150 for home energy audits

- $1,200 for insulation and air sealing

- $250 per door up to two doors

- $600 for windows

Once the HEEHRA rebate programs are set up by state energy offices, likely in 2024), low- and middle-income households can qualify for a $1,600 up-front rebate for home insulation, air sealing, and ventilation costs as part of their overall $14,000 home electrification bank account. That rebate will cover 100% of home insulation, air sealing, and ventilation costs (up to $1,600) for low-income households, and 50% of home insulation, air sealing, and ventilation costs (up to $1,600) for middle-income households.

For high-income households that don’t qualify for HEEHRA, the HOMES program will provide rebates for weatherization projects that are modeled to significantly increase a home’s overall energy efficiency.

- For projects that generate ≥35% energy savings, rebates will be available for the lesser of $4,000 or 50% of project costs.

- For projects that generate 20–34% energy savings, rebates will be the lesser of $2,000 or 50% of project costs.

- For projects that generate 15–19% energy savings, the rebates will be a bit more complicated, as a payment rate per kilowatt-hour saved, up to $2,000.

These HOMES rebates will also be doubled for low-income homes up to 80% of project costs. Since HEEHRA only applies to electrification projects, this may be a good option for low-income households that currently use inefficient electric systems like baseboard heating.

If you’re thinking about weatherizing your home, check out these resources on the subject from Environment America.

Electric vehicles

Electric vehicles (EVs) save on monthly fuel and maintenance bills. Thanks to their high efficiency and relatively small number of parts, they cost about one-third as much as a gasoline car to fuel (depending on where you live) and about half as much to maintain.

They also produce zero tailpipe emissions, thus reducing local air pollution and benefitting public health, especially in disadvantaged communities located near major roadways. Mining for the minerals needed to manufacture batteries does cause environmental and other adverse impacts, but those one-time effects are much less than the neverending need to drill for, extract, transport, and refine oil to burn in gasoline cars, along with the many pollutants generated by their combustion. Use of an EV also prevents any possibility of carbon monoxide poisoning from running your car in a confined space.

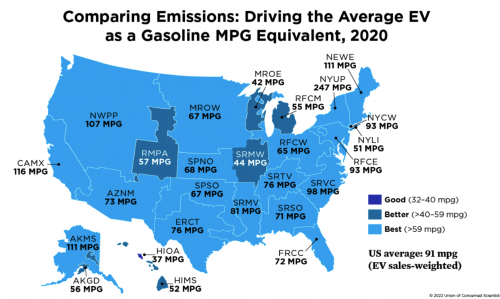

Some of the electricity needed to charge EVs comes from burning fossil fuels at power plants, but an increasing proportion comes from low- or zero-carbon sources. And even using the current US power grid, the carbon emissions from charging an EV are equivalent to those from a gasoline car achieving between 37 and 247 miles per gallon (mpg), with an average of 91 mpg as of 2020.

The IRA tax credits for new and used EVs (under Sections 30D and 25E of the US Internal Revenue tax code, respectively) are complicated. The good news is that starting in 2024, the EV tax credits became transferable to auto dealers. That means that consumers will be able to leave it up to auto dealers to determine which of their models qualify for the tax credits, and reflect them in a reduced sales price.

To qualify for up to $7,500 in tax credits, new EVs (including plug-in hybrids) and their purchasers must meet the following criteria:

- The EV must be manufactured in North America.

- Individuals must earn less than $150,000, or $300,000 for married couples filing taxes jointly.

- To qualify for half of the tax credit ($3,750), most of the value of the battery’s critical minerals must have been extracted or processed in the US or in a country with which the US has a free trade agreement, or have been recycled in North America (this will be determined by the IRS):

- 40% in 2023

- 50% in 2024

- 60% in 2025

- 70% in 2026

- 80% in 2027

- 90% in 2028

- 100% after 2029

- To qualify for the other half ($3,750) of the new EV tax credit, most of the value of the battery’s components must have been manufactured or assembled in North America (also determined by the IRS):

- 50% in 2023

- 60% in 2024 and 2025

- 70% in 2026

- 80% in 2027

- 90% in 2028

- 100% after 2029

- Starting in 2024, the tax credit will only apply if the vehicle’s battery components were not manufactured or assembled by a foreign entity of concern, which currently includes China.

- Starting in 2025, the vehicle’s battery cannot contain critical minerals that were extracted, processed, or recycled by a foreign entity of concern.

In what might be considered two ‘loopholes’ through these requirements:

- All EVs manufactured in North America qualify for the full $7,500 tax credit until the Department of Treasury finishes writing the aforementioned battery minerals and components sourcing requirements, which will happen in approximately March 2023.

- Auto dealers can qualify for a separate $7,500 commercial EV tax credit by purchasing them as commercial vehicles and then leasing them to consumers. The commercial EV tax credit does not have the assembly, income, sourcing, and manufacturing restrictions of the consumer EV tax credit. Auto dealers can then apply the commercial tax credit to reduce monthly EV lease costs.

To qualify for a tax credit worth the lesser of $4,000 or 30% of the sales price, used EVs and their purchasers must meet the following criteria:

- Individuals must earn less than $75,000, or $150,000 for married couples filing taxes jointly.

- The EV must be at least 2 years old.

- The sales price cannot exceed $25,000.

- The EV must weigh less than 14,000 lbs. This requirement ensures the passenger vehicle tax credit isn’t applied to heavy-duty vehicles.

- The battery capacity must be at least 7 kilowatt-hours (this corresponds to roughly a 32-mile electric range, so many plug-in hybrids qualify).

- The used EV must be purchased from a dealership, and it must be the first resale of the vehicle.

There are no assembly, sourcing, or manufacturing restrictions for the used EV tax credit. It applies regardless of where the vehicle and its components were made.

The IRA also includes a 30% tax credit for an EV charger (under Section 30C of the US Internal Revenue tax code) up to $1,000 if living in a non-urban or low-income community. “Low income” refers to communities in which one of the following applies:

- The local poverty rate is at least 20%.

- If in a metropolitan area: the median local family income doesn’t exceed 80% of the greater of the statewide median family income or the metro area median family income.

- If outside a metropolitan area: the local median family income doesn’t exceed 80% of the statewide median family income.

To see if you likely qualify, use Rewiring America’s IRA calculator.

If you’re thinking about getting a new or used EV, check out these resources on the subject from Environment America.

Rooftop solar panels and battery storage

Installing solar panels on a home rooftop will help curb global warming by producing zero-emissions electricity while also guarding against rising rates from the local electric utility. Adding a battery system can protect against power outages by storing clean electricity that can be used when the grid goes down.

While solar panel and battery production does cause environmental and other adverse impacts, those one-time effects are much less than the constant need to mine, drill, transport, refine, and burn fossil fuels for electricity, along with the many pollutants generated by their combustion.

Thanks to the IRA, there is a 30% uncapped tax credit (under Section 25D of the US Internal Revenue tax code) available for homeowners who install rooftop solar and/or battery storage, and the tax credit can also apply to electrical panel upgrades done in conjunction with a home solar installation.

An average 6 kilowatt solar system costs $15,300, in which case a 30% tax credit would be worth $4,600. An average battery storage installation with about 10 kilowatt-hour capacity costs $16,000, in which case a 30% tax credit would be worth $4,800.

If you’re thinking about getting solar for your home, check out these resources on the subject from Environment America.

Electrical panel and wiring upgrades

Adding all of these electrical appliances to a home may necessitate electrical panel and wiring upgrades. Electric stoves and heat pump water heaters typically require 220-volt outlets, for example, although some 110-volt models are becoming available. If considering these changes, it may be smart to upgrade electrical wiring ahead of time in order to make the appliance conversion as seamless as possible.

When electrifying your home heating system, adding solar panels, or installing an EV charger, you may need to upgrade your electrical panel to allow for greater electricity use. You may also need to work with your utility to increase the capacity of the electrical service to your home. Consider consulting an electrician about your home’s needs.

As noted in the solar section above, homeowners can apply an uncapped 30% tax credit to electrical panel upgrades done in conjunction with a home solar installation under Section 25D of the US Internal Revenue tax code. Or, section 25C offers a 30% tax credit up to $600 per year for electrical panel and wiring upgrades done separately.

Once the HEEHRA rebate programs are set up by state energy offices, likely in 2024, low- and middle-income households can qualify for a $4,000 up-front rebate for electrical panel upgrades and $2,500 for electrical wiring upgrades as part of their overall $14,000 home electrification bank account. That rebate will be able to cover 100% of those upgrade costs (up to $4,000 for panel upgrades and $2,500 for wiring upgrades) for low-income households, and 50% of heat pump costs (up to $4,000 for panel upgrades and $2,500 for wiring upgrades) for middle-income households.

What if I electrify and the power goes out?

Power outages are problematic for homeowners in all circumstances, in both electrified and fossil-fueled homes. Most appliances, including refrigerators, are electric, for example. Fossil-fueled furnaces also require electricity to operate critical components such as fans, and thus won’t function during power outages.

As noted above, battery storage systems can guard against power outages. Some EVs with bi-directional charging like the Ford F-150 Lightning can also serve that function. Homes at risk of lengthy power outages can use generators as a backup power source. They can use portable propane stoves for cooking.

None of this is a good reason to stick with fossil-fueled heating or cooking. On average, American homes are without power for just a few hours per year. If you rely on natural gas so that you can heat food and water during the 0.1% of the year when your power is out, you’re generating extra carbon and indoor air pollution during the other 99.9% of the year. That’s a bad trade-off.

- (0:00) Intro & Agenda

- (3:53) Why Go Electric?

- (12:15) Diving Into Home Benefits

- (28:27) Electric Vehicles

- (34:45) Solar, Batteries and other updates

- Dana Nuccitelli

- (0:00) Intro & Agenda

- (3:53) Why Go Electric?

- (12:15) Diving Into Home Benefits

- (28:27) Electric Vehicles

- (34:45) Solar, Batteries and other updates

- Dana Nuccitelli

- Rewiring America’s IRA calculator

- Rewiring America’s IRA explainer

- CCL blog post comparing the environmental and human impacts of ‘clean’ and fossil-fueled technologies

- Environment America's Clean Energy Home Toolkit

- Nerd Corner discussion on gas stove contributions to childhood asthma

- Carbon Switch article on heat pump savings

- Union of Concerned Scientists report on EV emissions

- IRS list of EVs qualifying for IRA tax credit