The Climate Leadership Council's Carbon Dividends Plan

The Climate Leadership Council's (CLC) Carbon Dividends Plan is a carbon pricing proposal advocated by many prominent conservative thought-leaders. It's important to note that this is not the same legislative proposal as the Energy Innovation and Carbon Dividend Act. This training page explores how their proposal differs from the Energy Innovation Act and highlights useful resources available from the Climate Leadership Council.

What is the Climate Leadership Council?

According to their website, “The Climate Leadership Council is an international policy institute founded in collaboration with a who’s who of business, opinion and environmental leaders to promote a carbon dividends framework as the most cost-effective, equitable and politically-viable climate solution.”

The Council's strategic approach primarily focuses on gaining Republican support by obtaining endorsements from prominent leaders and major companies (AT&T, BP, ConocoPhillips, ExxonMobil, Ford, GM, Johnson & Johnson, Microsoft, PepsiCo, and Unilever are all founding members). On the other hand, Citizens' Climate Lobby’s strategic approach focuses on demonstrating bipartisan support from constituents and state/district leadership for carbon fee and dividend. Also, Citizens’ Climate Lobby does not accept donations from the oil and gas industry.

In 2017, the Climate Leadership Council released “The Conservative Case for Carbon Dividends,” a report by eight distinguished conservative authors, including George Shultz and James Baker. An updated version of the plan was released in February 2020. It is sometimes called the Baker-Shultz Plan. The plan is similar to CCL’s carbon fee and dividend approach in many respects but differs in some significant details, and the two plans and organizations are sometimes confused with one another. CCL welcomes and appreciates the Climate Leadership Council, and the conservative leaders who wrote the Conservative Case for Carbon Dividends, for their contribution to the national discussion on how to address global warming.

What resources does the Climate Leadership Council offer?

Their publications can be helpful in showing support for the general concept of carbon fee and dividend and for showing support from conservative and business leaders as well as economists.

- The Economists Statement on Carbon Dividends. The largest public statement of economists in history including 3,554 U.S. Economists (this spreadsheet list sorted by state), four former chairs of the Federal Reserve, 27 Nobel Laureate Economists, 15 Former Chairs of the Council of Economic Advisers, and two former Secretaries of the U.S. Department of Treasury.

- Polling Data. Includes the recent Luntz Global national poll finding 4-1 overall support for the Baker-Shultz Carbon Dividends Plan, including 75% support from Republicans under 40. Note: According to Wikipedia, Frank Luntz, founder of Luntz Global, is a Republican party strategist and pollster.

- Founding Members. Top corporate statements of support for carbon fee and dividend policies. This group includes a remarkably broad coalition of corporate sector leaders. On their page, hover over Founding Member logos and names to read quotes, and see a complete list of statements here.

What are the basics of the Climate Leadership Council's Carbon Dividends Plan?

They describe the following four “pillars” in their report:

- Gradually Rising Carbon Fee. “An economy-wide carbon fee starting at $40 a ton (2017$) and increasing every year at 5% above inflation. If implemented in 2021, this will cut U.S. carbon dioxide (CO2) emissions in half by 2035 (as compared to 2005) and far exceed the U.S. Paris commitment. To ensure these targets are met, an Emissions Assurance Mechanism will temporarily increase the fee faster if key reduction benchmarks are not achieved.” The increase will be to 7.5% above inflation, and if the emissions still fail to meet the interim targets within 2 years, it will jump to 10% above inflation.

- Carbon Dividends For All Americans. “All net proceeds from the carbon fee will be returned to the American people on an equal and quarterly basis. A family of four will receive approximately $2,000 in carbon dividend payments in the first year. According to the U.S. Department of the Treasury, the vast majority of American families will receive more in carbon dividends than they pay in increased energy costs. The popularity of dividends will help ensure the longevity of a bipartisan grand bargain based on these pillars.”

- Significant Regulatory Simplification. “The third pillar is the streamlining of regulations that are no longer necessary upon the enactment of a rising carbon fee. In the majority of cases where a carbon fee offers a more cost-effective solution, the fee will replace regulations. All current and future federal stationary source carbon regulations, for example, would be displaced or preempted. This regulatory simplification will be contingent on the continued presence of an ambitious carbon fee. Trading regulations for a carbon price will promote economic growth and offer companies the certainty and flexibility they need to innovate and make long-term investments in a low-carbon future.”

- Border Carbon Adjustment. “Carbon-intensive exports to countries without comparable carbon pricing systems will receive rebates for carbon fees paid, while carbon-intensive imports from such countries will face fees on the carbon content of their products.”

Table comparing key elements of the Energy Innovation Act and the Climate Leadership Council’s proposal

Energy Innovation Act

Climate Leadership Council

Initial price per ton CO2e:

$15.00

$40.00

Annual increase per ton:

$10.00 ($15 if targets not met), adjusted for inflation

5% above inflation (7.5% if targets are not met, then further increased to 10% if targets are not met in 2 more years)

Use of revenue:

Return to households monthly

Return to households quarterly

GHG’s covered

Many, including methane

Only CO2

Border adjustments

Yes

Yes

Impact on existing regulation

Limited to stationary sources, rescinded if targets are not met after 10 years. See Energy Innovation Q&A (# 12) for details

Limited to stationary source with details unknown

Tort liability immunity

None

In Sept. 2019, CLC removed liability immunity from their plan

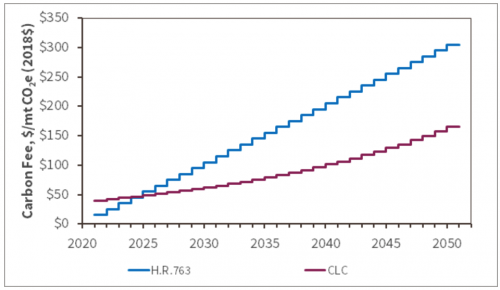

Carbon Price Comparison Table for the Climate Leadership Council's plan and H.R. 763 The Energy Innovation Act*

*These prices disregard general inflation and are listed in constant 2018 dollars. They both assume that targets are met every year, with the H.R.763 price starting at $15/mt and increasing by $10/mt annually, and the CLC price starting at $40/mt and increasing at 5% annually.

The eight original authors include three former Secretaries of the Treasury, two former Chairs of the President's Council of Economic Advisors, and two former Secretaries of State. Only two individuals in the 20th century have served as both Secretary of State and Secretary of the Treasury, and they are both authors on this paper (Baker and Shultz). More information on each of the authors is below:

- James Baker, III, served as Secretary of State under President George H.W. Bush, Secretary of the Treasury under President Reagan and White House chief of staff under both. He is a senior partner in the law firm of Baker Botts.

- Martin Feldstein served as Chairman of the President’s Council of Economic Advisers from 1982 to 1984 under President Reagan. He is the George F. Baker Professor of Economics at Harvard University and President Emeritus of the NBER.

- Ted Halstead is the founder, President and CEO of the Climate Leadership Council. Previously, he founded New America, a leading public policy think tank. He is co-author of The Radical Center: The Future Of American Politics.

- Henry Paulson, Jr., served as Secretary of the Treasury under President George W. Bush. Previously, he served as chairman and chief executive officer at Goldman Sachs. He is the founder and chairman of the Paulson Institute.

- George P. Shultz served as Secretary of State under President Ronald Reagan and as Secretary of Treasury and Labor under President Nixon. He is the Thomas W. and Susan B. Ford Distinguished Fellow at the Hoover Institution.

- Thomas Stephenson is a partner at Sequoia Capital, a venture capital firm based in Silicon Valley. Stephenson previously served as the United States Ambassador to Portugal from 2007 to 2009 under President George W. Bush.

- Gregory Mankiw served as Chairman of the President’s Council of Economic Advisers from 2003 to 2005 under President George W. Bush. He is the Robert M. Beren Professor of Economics at Harvard University.

- Rob Walton served as chairman of the board of Walmart, the world’s largest retailer and employer, from 1992 to 2015. He is currently Chairman of the Executive Committee of Conservation International.

Why did they write this?

The authors repeatedly cite in their writing and in their public statements that the mounting evidence of climate change is growing too strong to ignore. They advocate following the path blazed by President Ronald Reagan as he responded to the depletion of the ozone layer. Given the risks, President Reagan listened to the scientists and advocated for an insurance policy. This is just such an insurance policy for the risks scientists are warning us about global warming, and the authors wrote this solution to ensure that our insurance policy embodies long-standing conservative principles.

What is the Carbon Dividends Plan starting price?

Their carbon tax would start at $40.

What is their rate of increase?

The Climate Leadership Council plan was revised in September 2019 to specify it would increase every year at 5% above inflation.

Does their plan cover additional greenhouse gas emissions?

The Council's Carbon Dividends Plan would cover only CO2.

Where is it assessed?

The fee for their plan would be assessed upstream at the refinery or the first point where fossil fuels enter the economy, meaning the mine, well or port.

Where will the dividend go?

100% of the revenues from both the border adjustment and the fee would be rebated to Americans on an equal and quarterly basis. It is estimated that a family of four would receive approximately $2,000 in carbon dividend payments in the first year.

Which regulations would be repealed?

The Climate Leadership Council's plan suggests that “all current and future federal stationary source carbon regulations would be displaced or preempted.”

Is their dividend taxable?

That’s unclear. The CLC proposal states that the policy would be “revenue neutral” but does not say whether they achieve that by taxing the dividends or by applying a , 25% “haircut” to the dividend pool before distribution (see our laser talk “25% and Pay as You Go” for details).

How would this affect the U.S. commitment to the Paris Agreement?

Combining results from three studies (Chen and Hafstead, RFF 2016; Hafstead et al., RFF 2016; Treasury Department Office of Tax Analysis, 2017), a companion report titled “Exceeding Paris” estimates that a $40/ton tax applied only to CO2 emissions would be likely to deliver a 32% reduction in emissions by 2025, far exceeding our Paris commitment. By 2035, it would cut U.S. carbon emissions in half.

What is different compared to the Energy Innovation Act?

There are several differences between the Conservative Case for Carbon Dividends and the Energy Innovation Act legislation. The Energy Innovation Act applies to all greenhouse gases from fossil fuels and GHGs not found in nature (e.g. HFCs), whereas their proposal would only cover CO2. The Energy Innovation Act begins lower ($15 per ton) and increases faster ($10 per ton per year) and has a much greater impact on emissions beyond the first three years. The Energy Innovation Act does not include any excess revenues from the border adjustment into the dividends. We believe that would help keep the policy in line with the WTO. The Energy Innovation Act's dividend would be taxable to avoid the 25% offset and preserve revenue neutrality, while it is not clear how the CLC proposal would achieve that. The Energy Innovation Act would return a half-share of the dividend to each child rather than a full share.

How can I find out more information about the Climate Leadership Council?

There are more resources and white papers available on this proposal on the Climate Leadership Council website: https://www.clcouncil.org/