The Details Of The Text

This training dives into the actual legislative text of the monumental Energy Innovation and Carbon Dividend Act (H.R.5744) for all CCL volunteers to explore key questions and what the specific provisions of the text says.

What is the carbon fee rate?

Section 9902. (c), p. 8, line 22: -

‘‘(1) IN GENERAL - The carbon fee rate, with respect to any use, sale, or transfer during a calendar year, shall be—

(A) in the case of calendar year 2023, $15 per metric ton of CO2-e, and

(B) except as provided in paragraph (2), in the case of any calendar year thereafter--

(i) the carbon fee rate in effect under this subsection for the preceding calendar year, plus

(ii) $10 per metric ton CO2-e."

When would the fee rate escalate?

Section 9902. (c), p. 9, line 9: -

‘‘(2) EXCEPTIONS. (A) INCREASED CARBON FEE RATE AFTER MISSED ANNUAL EMISSIONS REDUCTION TARGET.

—In the case of any year immediately following a year for which the Secretary determines under 9903(b) that the actual emissions of greenhouse gases from covered fuels exceeded the emissions reduction target for the previous year, paragraph (1)(B)(ii) shall be applied by substituting ‘$15’ for the dollar amount otherwise in effect for the calendar year under such paragraph.”

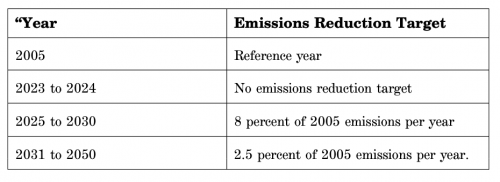

Emissions Reduction Target Table - Section 9903(a)(2), p. 12

When will the fee stop rising?

Section 9902. (c), p. 9, line 21: -

‘‘(B) CESSATION OF CARBON FEE RATE INCREASE AFTER CERTAIN EMISSION REDUCTIONS ACHIEVED.

—In the case of any year immediately following a year for which the Secretary determines under 9903(b) that actual emissions of greenhouse gases from covered fuels is not more than 10 percent of the greenhouse gas emissions from covered fuels during the year 2005, paragraph (1)(B) (ii) shall be applied by substituting ‘$0’ for the dollar amount otherwise in effect for the calendar year under such paragraph.”

When would the fee stop being paid?

Section 9904. p. 13, line 13:

“DECOMMISSIONING OF CARBON FEE.

‘‘(a) IN GENERAL .—At such time that—

‘‘(1) the Secretary determines under 9903(b) that actual emissions of greenhouse gases from covered fuels is not more than 10 percent of the greenhouse gas emissions from covered fuels during the year 2005, and (2) the monthly carbon dividend payable to an adult eligible individual has been less than $20 for 3 consecutive years."

Where will the fee be assessed?

Section 9907. (b)(1), p. 18, line 5:

‘‘(1) the identification of an effective point in the production, distribution, or use of a covered fuel for collecting such carbon fee, in such a manner so as to minimize administrative burden and maximize the extent to which full fuel cycle greenhouse gas emissions from covered fuels have the carbon fee levied upon them."

Why is there a carbon border adjustment?

Section 9908. (b), p. 19, line 11:

‘‘(b) PURPOSE .—The purpose of the carbon border fee adjustment is to protect animal, plant, and human life and health, to conserve exhaustible natural resources by preventing carbon leakage, and to facilitate the creation of international agreements."

How expensive will the program be?

Section 9512. (c), p. 28, line 1:

‘(1) ADMINISTRATIVE EXPENSES.—So much of the expenses necessary to administer the Carbon Dividend Trust Fund for each year, as does not exceed—

‘‘(A) in the case of the first 5 calendar years ending after the date of the enactment of this section, the administrative expenses for any year may not exceed 8 percent of amounts appropriated to the Carbon Dividend Trust Fund during such year, and ‘(B) in the case of any calendar year thereafter, 2 percent of the 5-year rolling average of the amounts appropriated to the Carbon Dividend Trust Fund.”

Who will receive the dividends?

Section 9512. (c)(3), p. 29 - line 16:

‘‘(C) ELIGIBLE INDIVIDUAL .—The ‘eligible individual’ means, with respect to any month, any natural living person who has a valid Social Security number or taxpayer identification number and is a citizen or lawful resident of the United States (other than any individual who is a citizen of any possession of the United States and whose bona fide residence is outside of the United States). The Secretary is authorized to verify an individual’s eligibility to receive a carbon dividend payment."

What about other social safety net programs?

Section 9512(c)(3), p. 30, line 6:

‘‘(E) FEDERAL PROGRAMS AND FEDERAL ASSISTED PROGRAMS —The carbon dividend amount received by any individual shall not be taken into account as income and shall not be taken into account as resources for purposes of determining the eligibility of such individual or any other individual for benefits or assistance, or the amount or extent of benefits or assistance, under any Federal program or under any State or local program financed in whole or in part with Federal funds."

What rights do states maintain?

Section 10. p. 37 - line 1: -

SEC. 10. NO PREEMPTION OF STATE LAW.

"Nothing in this Act shall preempt or supersede, or be interpreted to preempt or supersede, any State law or regulation."

See all resources associated with Energy Innovation Act.