How The Carbon Fee Is Assessed and Collected

This training explores the in-depth policy details behind how carbon-based fuels may be assessed their CO2 content, what it means to assess a fee as far upstream as possible, and follows the supply chain for coal, oil and natural gas to understand how the Energy Innovation Act might minimize the administrative burden of assessing a fee while maximizing the extent to which the fee captures the full fuel cycle greenhouse gas emissions.

What is it that gets measured?

- Carbon, of course. But how that relates to the fee is not quite what you may think. The fee is actually based on the carbon dioxide equivalent – or CO2e – for the fuel in question. That term means the amount of CO2 in addition to other greenhouse gases that are normally generated when the fuel is burned.

- If we know the percent of carbon in the fuel, we know how much CO2e it will produce. Every ton of carbon will produce 3.67 to 3.69 tons of CO2e. This varies slightly with the kind of fuel.

- All coal, oil, or natural gas is analyzed for its percent carbon at some point along the way from the source to the buyer. The only other thing needed is the metric tons of the fossil fuel. A metric ton is 1000 kg, or about 2,205 lb, and the shorthand for it is ‘mt.’

- So the amount of money the seller has to pay to the carbon trust fund is the metric tons multiplied by the percent carbon, multiplied by the CO2e for that kind of fuel, multiplied by the carbon fee rate at the time the fuel was sold.

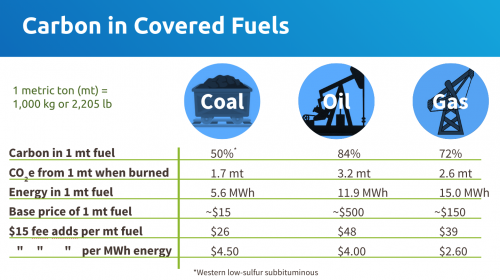

Carbon Content of Covered Fuels

- The fuels that are covered by the Energy Innovation Act are coal, oil, and natural gas.

- The table below shows data needed to understand how the carbon fee affects these different fuels:

- Row 1 shows the approximate percent carbon in these fuels.

- Row 2 shows how much CO2e each one produces from 1 mt of fuel.

- Row 3 shows how much energy each fuel contains in 1 mt. This is in megawatt-hours, which doesn’t apply only to electricity, but can be used to measure heat as well.

- Row 4 shows the approximate market price for these different fuels. One mt of this kind of coal goes for about $15. For oil, if you convert barrels to mt, that’s about $500 per mt. And for gas, the price goes up and down with the weather, but on average it’s about $150 per mt.

- Row 5 shows how much a $15 carbon fee would add to that price. So even though this kind of coal, widely used in power plants, has the least carbon, it takes the biggest percentage price increase. Adding $26 to a ton almost triples the price. Looking at oil, that $48 only adds about 10% to the price. Natural gas gets hit with a price increase of about 25%.

- Row 6 shows the price increase based on energy produced. Now you can see why coal is the most affected by the carbon fee, and gas is the least affected. Now when you consider electricity, that’s a fight between coal, gas, and renewables, because very little oil is used for generating electricity. So these prices mean that gas will benefit in competition with coal, but renewables and nuclear power will grow even faster than gas because they have zero carbon..

- Electricity is only part of the picture. Oil is used mainly in transportation, and gas is widely used for heat. Since those involve a big markup for consumers, it takes a little longer for the carbon fee to have an impact, mainly through long-term purchase decisions like vehicles and heating systems.

Understanding Upstream and Downstream

- Two terms that are important to understand in the context of imposing the fee are ’upstream‘ and ’downstream’.

- Imposing the fee ‘upstream’ means close to the source of the fuel – where the carbon enters the U.S. economy, near the mine or well or at a port of entry. The advantage of an upstream imposition of the fee is that it captures greenhouse gas emissions from all stages of the supply chain, from production to refining to consumption.

- A ‘downstream fee’, on the other hand, means imposing it close to the end use of the fuel, which is where the energy is consumed. This would be at a power plant or gas meter, or in the case of gasoline, at the pump. The disadvantage of a downstream fee is that it would normally include only CO2 emissions from combustion of the fuel, not all the stuff that gets emitted at the refinery or in various operations all the way back to the well or mine. And those emissions can be considerable – as much as 20 percent of the total. Of course, the fee could include a flat surcharge to include those upstream emissions, but then there would be no cost incentive for producers to reduce them.

Fossil Fuel Supply Chains

How might we measure the vast majority of carbon that causes U.S. emissions?

Coal's Supply Chain- Coal comes out of the mine along with a lot of rocks and dirt and water. That’s called ‘run of mine’ coal. It gets weighed and analyzed, which reveals the amount of carbon, and then goes to a preparation plant where it’s crushed, dried, and cleaned up so it’s suitable for burning.

- From the prep plant, it gets loaded into rail cars and shipped to customers. Mostly those are power plants, but there are also smaller users like steel mills and manufacturers who burn it for heat. A fair amount is also exported.

- Finally, the end products include electricity and materials like steel or other metals that end up in consumer products. A part of the decision-making process to determine where the carbon fee is imposed depends on how many of these transacting entities have to be dealt with.

- There are about 850 coal mines, 500 prep plants, 600 power plants and steel mills, but millions of consumers. These first three are roughly equivalent, but if we want to impose the fee as far upstream as possible, it makes sense to do it at the weigh feeder, located between the mine and the prep plant. This is a device that weighs the coal while it’s moving it from one place to another, and where the buyer learns how much coal they’re buying from the seller.

- There are many hundreds of thousands of wells that connect to various sized pipelines. At certain points between these pipelines and the receiving refineries are located special devices called Lease Automatic Custody Transfer (or LACT) meters. That’s where the oil flow and density are measured, which correlates well with the carbon content. Essentially, this is the ‘first point of sale.’ Further downstream is the refinery, where the oil is processed into fuels and chemicals. The fuel products – gasoline, diesel, jet fuel, and others – are shipped by truck, train, or barge to the consumers, which would be gas stations, truck terminals, airports, etc.

- Some oil well operators also collect what’s called ‘associated’ natural gas and pipe it to gas processing plants.

- Also, refineries sometimes purchase liquid hydrocarbons like propane that are recovered from natural gas wells. These are termed ‘gas liquids’.

- Some of the products made in refineries, like asphalt and polymer feedstocks, don’t get burned, and so will be entitled to a carbon fee refund at some point. And, of course, some products are exported.

- The oil supply chain is different from coal because there are nearly half a million oil wells – far more than coal mines, so it’s impractical to assess a fee at every single one. There are about 30,000 LACT meters, but they are already set up to measure everything needed to quantify carbon, There are about 140 refineries, but about 100 million downstream consumers. Thus, it makes sense to assess the fee at the LACT meter, since those data are already tabulated and reported to the leaseholders, to state and local taxing bodies, and finally to the buyers. Collection of the fee could be at that point, or if it is deemed more practical, it could be collected from the refinery based on the data acquired from the LACT meters.

- Imported oil must also be measured for carbon. The amount and composition of imported crude oil will be specified on the shipper’s manifest. There may be some spot checking by authorities, but in essence, the data needed to assess the fee will be available at the port of entry.

- The supply chain for gas looks a lot like the one for oil. Lots of wells feed into lots of pipelines. Instead of LACT meters there are ‘metering skids’ that do basically the same thing – measure and analyze the gas in support of the sale. Instead of refineries, the gas is cleaned up, removing water, sediment, sulfur, and excess CO2, at processing plants, from which the pipeline-quality gas is directed into high-pressure interstate transmission pipelines. From those pipelines it finds its way to lower-pressure distribution systems that pipe it to homes and businesses or may be piped directly, at high pressure, to the growing number of power plants that burn natural gas.

- Gas well operators also recover gas liquids which, as mentioned earlier, they sell to refineries. Some natural gas is also exported.

- Finally, the processing plants also takes in associated gas recovered from some oil wells.

- The number of transacting entities in the natural gas supply chain look a lot like the ones for oil. Hundreds of thousands of wells, about a tenth as many metering stations, about 500 processing plants, 150 interstate pipeline, and about 70 million end-use consumers. So the logic of where to assess and where to impose the fee looks similar. The logical point of carbon fee assessment is at the metering skid – the first point of sale – and, depending on the details, the fee may be imposed there or as far downstream as the processing plant.

- A special thanks to Team O.I.L., who have worked together over the last couple of years to produce a Point of Assessment Working Paper, which you can find on their Community page, if you want to learn more about what I’ve just showed you.

What does H.R. 763 say about assessing the carbon fee?

There are three sections that form the legislative basis for carbon fee assessment and collection.

The first is Section 9901. Definitions

- ‘Greenhouse Gas Content’ defines the meaning of CO2-equivalent (CO2e) for legislative purposes, so the basis for the fee is clear.

- ‘Covered Fuel’ designates crude oil, natural gas, or coal, but also specifies any product derived from any of those that ‘shall be used so as to emit greenhouse gases to the atmosphere.’ This is to make sure that anything made from fossil fuels and then later combusted can’t evade the fee.

- ‘Covered Entity’ designates the refinery, coal mine, pipeline gas supplier, or importer of any of these fuels, but also includes a broad ‘fill-in-the-blanks’ category which says ‘any entity or class of entities which … is transporting, selling, or otherwise using a covered fuel in a manner which emits a greenhouse gas to the atmosphere and which has not been covered by the carbon fee.’ This language allows the possibility to move the imposition of the fee further upstream.

- ‘Upstream Greenhouse Gas Emissions’ is defined as ‘greenhouse gases emitted to the atmosphere resulting from, nonexclusively, the extraction, processing, transportation, financing, or other preparation of a covered fuel for use’. This dense legal language is also meant to plug any loopholes which could help someone evade the fee for significant GHG emissions, and to cover as much of them as possible.

- ’Full Fuel Cycle Greenhouse Gas Emissions’ simply adds the greenhouse gas content to the upstream greenhouse gas emissions. It turns out to be important for both the carbon fee and the border adjustment, so as to equalize the fees imposed in all cases in compliance with World Trade Organization rules.

- Imposition of the Fee - wherein the carbon fee is ‘imposed’ on any ‘covered entity’s emitting use, sale, or transfer’ of a covered fuel ‘for an emitting use’. This is intended to cover emissions not only at from power plants or cars, but process emissions at the refineries or gas processing plants. Note that together with the broad definition of a covered entity, this allows the governing agency to designate any entity that ’sells, transports, or otherwise uses’ a covered fuel so as to emit greenhouse gases.

- Amount and Rate of the Fee - The bill distinguishes between ‘amount’ of the fee and ‘rate’. The ‘amount’ simply designates the calculation which is the greenhouse gas content multiplied by the ‘rate’, which is the dollar amount of the fee. As we all know, that’s $15 per mt in the first year, followed by $10 per mt more each succeeding year, except if the emissions targets are not met, which would ratchet the annual increase up to $15 per mt.

- Inflation Adjustment - this provision was not in the 2018 version of the bill, but is really important so that the fee doesn’t become ineffective as the years go by. Carbon fee amounts will be escalated by applying a cost-of-living adjustment relative to the year 2018.

- Authority to Prescribe Regulations for Imposing the Fee – this provision gives the Treasury Dept, in ‘consultation with’ the EPA, the authority to prescribe regulations and guidance for imposing the fee. It directs them to identify the covered entities, devise a way to collect monthly payments from those entities, distinguish between how the fees are assessed for the different fuels, and distinguish between greenhouse gas content and upstream emissions. All this adds up to the authority to prescribe methods that can assess the carbon in each fuel separately from assessing upstream emissions, if that’s necessary.

- Authority to Identify the Point of Collection - here the legislation directs the Treasury to identify ‘an effective point in the production, distribution, or use of a covered fuel for collecting such carbon fee’. It includes both ‘regulations’ and ‘guidance’, which differ in that although regulations have to go through a lengthy formal process, guidance doesn’t require that. Guidance just constitutes directives that can be issued at any time to quickly respond to changing circumstances.

Regulatory Discretion: Two Competing Directives

Two governing directives are meant to clarify what ‘an effective point’ means in the section described above.- The Treasury Dept is directed to ‘minimize administrative burden,’ but also to ‘maximize the extent to which full fuel cycle greenhouse gas emissions’ are hit with the carbon fee.

- The regulators must figure out exactly how and where the fee is most efficiently imposed to hit the ‘sweet spot’ for both of these requirements. The bill does not spell it out, but at this time we believe the first point of custody transfer, with carbon flow measured by the devices we’ve identified, is probably going to be optimal for assessing the fee, and possibly for collecting the fee as well. As for emissions not captured by the carbon measurement, that may require regulators to dig deeper into the best ways to address things like leakage, flaring, and other upstream emissions that may resist direct measurement.

- Some may worry that leaving so much up to Cabinet departments could allow a future administration that is hostile to this climate policy to weaken or undermine the program.

- They should take comfort in the fact that the foundational authority of the government to regulate greenhouse gases – the endangerment finding under Massachusetts v. EPA – is unchanged by this bill.

- There is also a guardrail because legislative intent is clear, and courts are very loath to allow regulators to undermine the intent of Congress when the legislation was first written.

- Even if a future administration wants to undo regulations, the changes must be justified and follow a process that involves a period of public comment and allows for court challenges. We’ve seen this play out where the Trump Administration has tried to undo many environmental regulations, but hasn’t actually succeeded in many cases. Once all the legislative boxes have been checked, the policy is pretty resistant to being scuttled.

- Furthermore, once market forces have been set in motion, they take on a life of their own, and it’s very hard to reverse a massive transformation that has developed momentum and obtained public support.

In Summary

- H.R.763 leaves a considerable amount up to regulatory discretion. This is pretty routine in legislation, because trying to cram everything into a bill before getting it through the long gauntlet of committees, floor votes, and signature into law would just take forever. Fleshing out the fine details is why we have Cabinet Departments and Agencies to interpret and implement the laws. In this case, the agency designated to carry out the law is the Treasury Department ‘in consultation with’ the EPA. A key pair of directives for imposing the fee is to ‘minimize administrative burden and maximize effectiveness.’

- CCL’s research on assessment and imposition of the carbon fee helps provide guidance to legislators and regulators as the policy moves through the gauntlet. This is why we want to understand the industry. We can’t let our eagerness to make fossil fuels go away dissuade us from deep understanding of the industry this legislation seeks to regulate. It’s wise to take advantage of existing infrastructure such as those LACT meters and other resources that already exist, and it’s also wise to leverage existing business and compliance practices to the extent possible.

- The more expertise CCL can develop in these areas, the more effectively we can steer the outcome to achieve a livable climate.

Intro & Agenda

(from beginning)

Measuring Carbon Content

(3:38)

Supply Chains for Coal, Oil & Gas

(13:25)

H.R. 763 & Fee Placement

(20:17)

Regulatory Discretion & Summary

(29:18)

Rick Knight

Download the Powerpoint or Google Slides Presentation.

Intro & Agenda

(from beginning)

Measuring Carbon Content

(3:38)

Supply Chains for Coal, Oil & Gas

(13:25)

H.R. 763 & Fee Placement

(20:17)

Regulatory Discretion & Summary

(29:18)

Rick Knight